NOTE: The information in this blog comes from indictments and depositions in the civil trial of the auditors for Dixon Illinois. The case is currently on trial. The final verdict will determine the guilt or innocence of the defendants. I’ve taken factual statements from these documents.

*****************************

One of my concerns with the auditing profession (which I’ve been a part of for more than 39 years) is, “Do we pay attention to the past? Do we pay attention to why prior frauds occurred, what was the cause of the frauds, and why did the auditors not detect it?”

Many of the past frauds I’ve studied identified similar

mistakes made by the auditors in the Dixon fraud. Too bad the Dixon auditors also

didn’t study the past.

Another source of information to aid auditors in areas that

need attention is the inspection reports now issued by the Public Company Accounting Oversight

Board (PCAOB).

In February 2013, the PCAOB issued Release No. 2013-001, its

Report

On 2007-2010 Inspections Of Domestic Firms That Audit 100 Or Fewer Public

Companies.

Some of the areas the PCAOB identified are applicable to the

Dixon fraud. These include:

- A lack of technical competence in a particular audit area;

- A lack of due professional care, including professional skepticism;

- Insufficient testing of the completeness and accuracy of source documents;

- Ineffective or insufficient supervision,

- Ineffective engagement quality reviews.

The report authors go on to say:

“The consideration of the risk of

material misstatement due to fraud is an integral part of the audit under PCAOB

standards. PCAOB standards require that the auditor plan and perform the audit

to obtain reasonable assurance about whether the financial statements are free

of material misstatement, whether caused by error or fraud….

“Inspections staff have identified

deficiencies relating to firms' consideration of fraud in a financial statement

audit that include firms' failures to: (a) sufficiently test journal entries

and other adjustments for evidence of possible material misstatement due to

fraud, including assessing the completeness of the listing of journal entries

and other adjustments that is [sic] used for testing purposes; (b) consider the

risk of material misstatement due to fraud relating to revenue recognition or indicate

why revenue recognition would not be considered a fraud risk; (c) make

inquiries of the audit committee, management, and others as to their views

about the risk of fraud; (d) conduct a brainstorming session by members of the

engagement team to discuss fraud risks, (e) obtain an understanding of the

issuer's controls over journal entries and other adjustments, and (f) assess

the risk of management override of controls.

“Firms should design and perform

audit procedures that address the fraud risks, including reassessing risk and

adjusting procedures as appropriate during the audit. The auditor should

exercise professional skepticism, and conduct the audit engagement with a

mindset that recognizes the possibility that a material misstatement due to

fraud could be present”

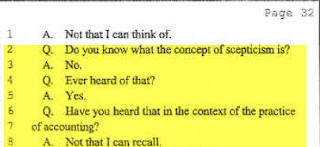

Unfortunately, in the Dixon fraud we had a partner who claims

he didn’t know about the concept of professional skepticism.

They also had an audit manager who didn’t think examining a check

could help tell if fraud had occurred.

Again, these statements are made under oath and are in a

pending court case. It’s just one more piece of evidence that the auditing profession

has a long ways to go to ensure it is providing appropriate accountability to

the people who are depending on the audit work done.